Why Run This Report:

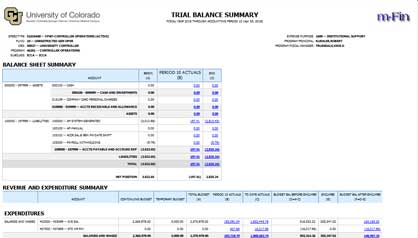

To view the Balance Sheet Summary and the Revenue and Expenditure Summary within one report, with page breaks by SpeedType.

Key Notes

Tips

- Trial Balance Summary vs Trial Balance Total: Summary presents SpeedType-level information; Total presents fund-level information

- Current: Shows actuals from this period forward. Allows you to see a specific timeframe within the overall fiscal year. Ex. Current quarter compared to entire year

- GM Sponsor Budget: Refers to budget entered in the Grants Module, which could be different from budget in the General Ledger

- Single SpeedType: The fastest option for running one ST. The prompt also appears on the report output, allowing you to key in another ST without having to return to the initial prompt page (note: Next options are not available, only Finish)

FAQs

Q: When do you want to use the Trial Balance rather than other reports?

A: The Trial Balance Report is helpful when starting a monthly reconciliation if you have a limited number of SpeedTypes that you’re reviewing that don’t fall into a singular category (e.g. they don’t fall into one Org or they are not all from a particular fund).

The Trial Balance Report presents a balance sheet and an income statement for a point in time and focuses on a Fiscal Year. It presents information that helps you figure out the health of a SpeedType at a quick glance.

Q: Can I run the Trial Balance Summary Report across Fiscal Years (e.g. for the calendar year)? Is there a better report I may want to run?

A: The Trial Balance report does not cross fiscal years. Depending on how you want to see the data, you could try:

m-Fin Org Expenditures by Month (found in Finance > Org Reports folder) - aggregates balances at the Org level m-Fin BAE by Month - run reports for January-June and July-December to see the calendar year m-Fin Financial Detail (Original or Detail II)

Q: Can you help me better understand the Assets and Liabilities section (specifically for fund 10s)? Why is Cash 0?

A: In fund 10, budget indicates spending authority. Each campus, in accordance with their respective policies, provides a budget for units to spend throughout the year, instead of cash. Throughout a month, normal activity causes cash to increase or decrease so that the SpeedType can balance. That cash balance is consolidated (or rolled up) at the end of each month to a central campus SpeedType. This is why you might see a cash balance during the month, but the balance will be zero after month-end close. Other Assets and Liabilities behave as one would expect, regardless of fund.

Q: What might be most helpful to know when running this report for a Fund 30?

A: Where fund 30 is concerned, revenue is a function of expenses and follows expenses. Revenue Recognition is managed in the background by Grants Module processes and is not something end users manually control like expenses. So, don’t place as much weight on revenue as you would expenditures for a fund 30.

Where the Balance Sheet is concerned, those items are managed by the central sponsored projects offices on each campus. If you have questions on these items, reach out to your campus sponsored projects office.

Q: Why does the Net Position not match the Budget Balance after Encumbrances?

A: Net position is a function of assets minus liabilities. To the extent that Actual transactions impact Cash, AR, or AP, those transactions are a part of that calculation. Budget and Encumbrance transactions do not affect assets or liabilities; therefore, they are not part of the Net Position calculation.

for full screen.

for full screen.